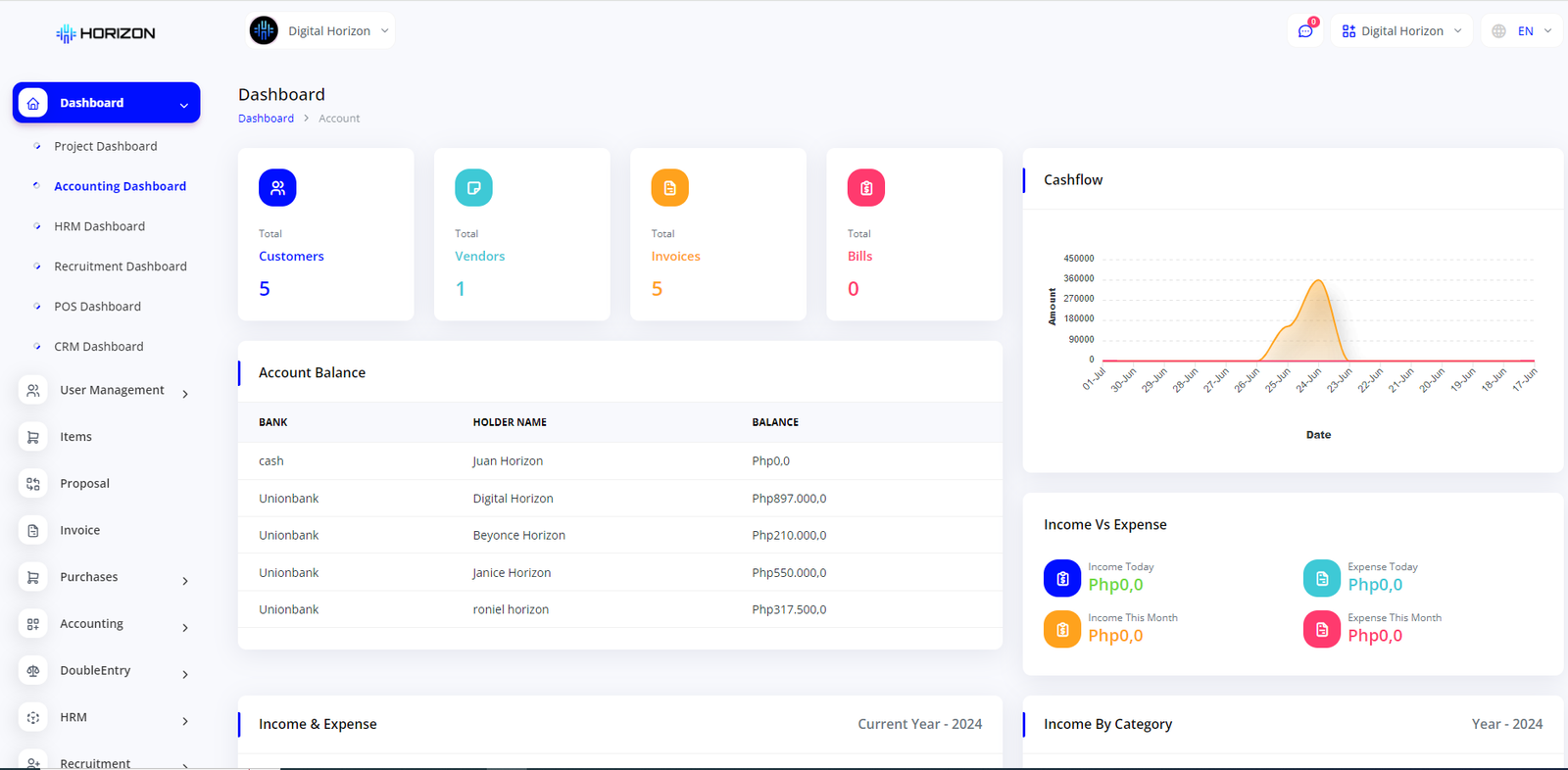

Accounting Management System

Manage Accounting

"Best Erp System In the Philippines"

Smart Solution For Modern Business

- Free online course training

- After Sales Support

- Business Owners Community

features

Take Control Of Your Inventory

Enterprise Resource Planning System (ERP)

We offer web-based Human Resource Management Systems that simplify HR processes and boost workforce efficiency. Our user-friendly, innovative solutions ensure seamless integration and real-time access.

01

Human Resource Management System (HRM)

We offer user-friendly, web-based Human Resource Management (HRM) systems that make managing HR tasks simple and efficient. Our solutions help streamline processes, boost employee productivity, and provide real-time insights, empowering your business to grow and succeed

02

Point Of Sale (POS)

Offering intuitive, web-based Point of Sale (POS) systems that streamline transactions, manage inventory, and provide real-time sales insights. Our user-friendly solutions enhance customer experience, boost efficiency

03

Property Management System (PMS)

We offer all-in-one solution for hassle-free property management. From rent collection to maintenance tracking, our user-friendly platform empowers you to effortlessly oversee your properties, ensuring peace of mind and happy tenants.

04

Digital Business Card

Introducing our digital business cards, an eco-friendly and convenient way to share your contact information. Easily customizable and instantly accessible, our digital cards help you make a lasting impression while keeping all your details up-to-date and at your fingertips.

05Manage All Your Products

Make it easier to manage your stock by creating different product categories. Add products to different categories for more in-depth reporting. Modify product price, add SKUs, and more!

Handle Product Tax With Ease

Save more time and more money by automating your product taxes. Create different tax rates for each of your products and get them automatically applied to transactions.

Sell Your Products Faster

Get new sales and get paid faster. Create proposal templates for your products, pitch them to your future clients, and turn accepted proposals into invoices - in just a few clicks.

Pricing

Basic

Billed Yearly- Accounting Management

- Financial Tracking

- Invoce Management

- Real-Time Reporting

- Expense Monitoring

- Up to 50 User

- Own Domain and hosting

Standard

Billed Yearly- Accounting Management

- Financial Tracking

- Invoice Management

- Real-Time Reporting

- Expense Monitoring

- Up to 100 User

- Custom Domain

Enterprise

One Time Payment- Accounting Management

- Financial Tracking

- Invoice Management

- Real-Time Reporting

- Expense Monitoring

- Unlimited User

- Own Domain and hosting

Have a question?

Frequently Asked Question

AMS systems maintain detailed audit trails of financial transactions, providing transparency and accountability while facilitating internal audits and compliance checks.

An Accounting Management System (AMS) benefits businesses by automating financial processes, ensuring accuracy in financial reporting, and providing insights for informed decision-making. It streamlines tasks like transaction recording, invoice management, and budgeting, reducing manual errors and saving time. AMS generates comprehensive financial reports quickly, enabling managers to analyze performance and make strategic decisions based on real-time data. It enhances compliance with accounting standards and regulatory requirements, improves cash flow management, and supports growth by scaling operations efficiently.

An Accounting Management System (AMS) encompasses essential features like general ledger management for organizing financial transactions, accounts payable and receivable management for handling payments and invoices, robust financial reporting capabilities for generating balance sheets and income statements, budgeting tools for planning and forecasting expenses, fixed assets management for tracking and depreciating assets, bank reconciliation to ensure transaction accuracy, multi-currency support for international transactions, audit trail features for compliance and transparency, integration with other business systems for seamless data flow, stringent security measures, and scalability to accommodate business growth and customization to adapt to specific organizational needs. These features collectively streamline financial operations, enhance accuracy in reporting, support decision-making, and promote overall operational efficiency.

Accounting Management System (AMS) can integrate seamlessly with other business systems such as ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), payroll management, and inventory management systems. This integration allows for smooth data flow and eliminates the need for manual data entry across different platforms. By syncing financial data with other operational systems, AMS enhances overall business efficiency and accuracy in decision-making. It facilitates a unified view of business operations, improves collaboration between departments, and ensures consistency in financial reporting and analysis. This interoperability helps businesses streamline processes, reduce duplication of efforts, and adapt more quickly to changes in their business environment.

AMS systems employ robust security measures such as encryption, access controls, regular backups, and compliance with data protection regulations to safeguard financial data.